Summary of responses to consultation questions

Chapters 2 and 3 of the Issues Paper included specific consultation questions which we considered to be important for informing the development of the gas transition plan. The responses to these questions are summarised here.

On this page

Transitioning our gas sector

Chapter 2 of the Issues Paper covered the uncertainties and challenges in the gas sector, including the conflicting needs for investment in gas production and infrastructure and for a transition to a smaller gas market.

Submitters saw risks if the transition to a smaller natural gas market is poorly managed

We asked submitters how New Zealand can transition to a smaller gas market over time. In their responses, most submitters expressed concern that a poorly managed transition could lead to the premature and disorderly collapse of the gas market, which could be very costly to the country and reduce the reliability of New Zealand’s energy system.

Submitters saw a risk of de-industrialisation – the threat of collapse and a restricted gas supply could drive firms to other countries, where their impact on global emissions may be higher. Other highlighted risks included gas pipeline businesses becoming financially unsustainable, affordability impacts, stranded assets, and inefficient use of resources.

However, submitters had varied ideas about what a managed transition should look like. Some believed that a managed transition to a smaller natural gas market should involve a reduction in demand for gas and government intervention to drive this change. Government could do this through encouraging increased energy efficiency, using pricing mechanisms, connection bans, and a concentrated effort to electrify as much as possible. Others saw it being achieved through a transition to renewable gases.

Several felt that the market should determine the gas transition, with any decline in the natural gas market driven either by natural depletion of resources, or substitution of gas by alternatives (facilitated by the Emissions Trading Scheme). Some believed that we should not be ruling out natural gas a potential least-cost pathway to emissions reduction, and that we should also consider other means of emissions reduction such as carbon capture or other opportunities outside of the gas sector. Some felt that growth in the gas market was preferable to it being encouraged to shrink.

Many submitters believed that New Zealand should maintain gas infrastructure to retain options – for example, it could be repurposed for renewable gases in the future or operated at lower pressure to allow for a lower volume gas market. They were concerned that shutting down infrastructure too quickly would have negative impacts on consumers, taxpayers and the electricity sector.

The Gas Transition Plan should consider market segment prioritisation

Submitters highlighted various gas users and market segments they believed should be prioritised as part of the Gas Transition Plan.

Some, for example Vector, called for a focus on decarbonising gas-fired electricity generation and industrial processes, rather than residential gas consumption:

“residential gas consumption only accounts for 5% of all natural gas use. Meaningful decarbonisation of fossil gas is largely an exercise in reducing gas-fired electricity generation and industrial processes.”

Some prioritised energy security and affordability for communities (including public services, marae, papakāinga, households, and some essential small businesses), rather than maintaining security of natural gas supply for large industrial users. Some felt that these consumers should be the first to transition due to the availability of alternatives and risks of increasing gas prices. Some were also concerned about the negative health impacts of household gas use.

Some believed the Gas Transition Plan should focus on transitioning the public sector. For example, according to the PSA:

“…750 schools, hospitals, and public buildings are still waiting on funding to transition away from fossil fuel use, and the majority of these are using fossil gas… The gas transition plan should include a plan to fully fund and implement the transition away from fossil gas in the public sector, including deadlines for the transition to be completed.”

Most submitters saw a role for government in enabling continued investment in the gas sector to meet energy security needs

36. We asked submitters whether they saw a role for government in enabling continued investment in the gas sector to meet energy security needs. Of the 32 that responded, 25 submitters indicated that they saw a role for government in enabling investment, 6 indicated they did not see a role for government and 1 said they did not know.

Submitters called on the Government to provide investors with confidence over the transition period

Most of the submitters who saw a role for Government believed its role was to provide clear direction and stable regulatory settings to give investors enough confidence to invest in gas supply.

Some of these submitters mentioned that long term certainty is needed because investment in gas production is needed several years in advance, and a minimum level of investment is also needed to maintain gas pipelines.

Several submitters suggested that, to give investors more confidence, the Government should clearly communicate the importance of natural gas for energy security, proactively engage with industry and give an indication of timelines for the transition. Some also suggested that regulations should have mechanisms that provide companies with recourse if terms of licence are changed by subsequent governments.

As part of its wider role in creating investor confidence, submitters asked the Government to consider risks and decisions about the gas transmission pipeline network and clearly communicate its intentions, eg settings for pipeline revenue.

Some submitters expressed views that the government should actively encourage gas production and consumption, for example:

- Government should support the use of gas in electricity peaking, eg through wholesale electricity arrangements to support and enable effective participation by gas fired peaking and firming generators.

- Government could send a positive signal to investors by repealing the offshore exploration ban and reinstating the purpose of the Crown Minerals Act to promote exploration. Support for CCUS could also send a positive signal.

- Government should avoid policies which send a negative signal to investors, eg connection bans, 100 percent renewable electricity by 2030.

- Government should work with major users such as Methanex and Ballance to develop transition plans and prevent their exit.

- Investors may require an underwrite from Government for new investments that may be impacted negatively by future policy.

Some submitters called for the Government to actively discourage investment in gas

Some submitters felt that, rather than creating an enabling environment for investment in natural gas supply, the Government should minimise the need for investment by actively managing a decline in gas demand. They believed that reduced natural gas consumption could make existing gas reserves go further, removing the need for further offshore exploration and the associated investment.

While these submitters also called on the Government to send clear signals regarding timelines for the transition, their views differed from those expressed above on what these signals should be. They wished for the Government to discourage unnecessary investment in gas infrastructure in anticipation that gas consumption would decline.

Suggested measures included shutting down uneconomic sections of the gas pipeline network (network “right-sizing”), developing a regulatory regime which supports managed decommissioning of pipeline infrastructure, and prioritisation of gas supply to users who are less able to transition, eg hard to abate industries.

Submitters believed Government would need to address barriers and potentially provide support to right-size the network. This may include enabling a right to disconnect, enabling network operators to continue recover revenue from assets and provide funding so decommissioning costs are not borne by consumers.

Some submitters called for support of renewable alternatives

Some submitters suggested that scaling up renewable alternatives could help to prolong natural gas availability from established reserves by reducing overall demand. Some suggested that biogas blending could reduce overall demand for natural gas while incentivising investment in gas infrastructure and continued production during the transition.

Some saw a role for renewable gases as transition fuels which could help maintain a market for gas and therefore maintain availability of natural gas. Others believed that the focus should be on replacing natural gas with renewable alternatives, particularly renewable electricity (also demand response and community energy), rather than maintaining availability of natural gas, with the goal being to reduce natural gas demand as quickly as possible.

Suggested measures included recognising the value of renewable gases and proactive support for development and expansion of the renewable gas industry. These measures are expanded upon further below in the summary of responses to questions regarding renewable gases.

A few submitters noted that it is important to determine availability of renewable alternatives to predict likely demand for natural gas and ensure an appropriate level of investment in production.

Several submitters called for changes to regulatory settings for gas pipeline infrastructure

Several submitters felt that current regulatory settings, including the regulation related to revenue gas pipeline businesses can collect, risk undermining investment in the gas pipeline network. They believed that regulatory changes are needed to provide confidence to investors and encourage investment in the gas network, to ensure pipeline businesses can recover capital expenditure over time and minimise the risk of stranded assets. They expressed concern that future consumers will bear cost of regulatory failure.

In particular, some submitters called for amendments to Part 4 of Commerce Act, regarding price quality regulations, the impact of decarbonisation, depreciation and the ability to recover costs. Submitters called on MBIE to coordinate with the Commerce Commission and gas pipeline businesses to come up with appropriate regulatory settings.

Submitters also called on the Government to provide clarity on responsibility for decommissioning costs and potentially coordinate any decommissioning, particularly if renewable gases turn out to be not viable or not demanded by consumers. They asked the Government to be open to different types of interventions, such as an end-of-life fund and decommissioning levies, nationalisation and other financial mechanisms (eg government backed bonds, accelerated depreciation, revenue cap model and removing index inflation).

Pricing has a strong influence on investment decisions

We asked submitters what factors they saw driving investment decisions. Most mentioned economics in their response, ie the price and cost of gas supply. Several of these submitters saw decisions being based on the cost of producing gas plus the cost of NZ carbon units under the ETS. A couple also mentioned the comparative economics of gas pipelines versus the electricity network.

Submitters generally agreed the ETS should be used to price the externalities of natural gas use, and its price pathway should be predictable. Some advocated for stable and affordable NZU prices to maintain competitiveness of domestic industry, while others called for price increases to drive down demand. Some called for maintenance of industrial allocations under the ETS, while some others called for their removal.

Demand forecasts are an important factor in investment decisions

Several submitters saw expected demand as an important factor in investment decisions. In particular, they recognised demand from large users (particularly Methanex) as a driver of investment decisions. 56. Some submitters felt that demand for electricity peaking should be a factor which drives decisions but that it currently contributes to indecision because the exact scale of this demand and its profile over time is uncertain.

Another factor mentioned was increasing consumer demand for low carbon products, which could lower demand and discourage investment in gas production.

Availability of new and alternative technologies will also drive investment decisions

Several submitters saw availability and relative cost of alternative renewable energy sources, such as renewable electricity and bioenergy, to have an influence on investment in gas production. Some also expected technology advances in CCUS and hydrogen production to influence decisions.

The Government has a role in supporting vulnerable residential consumers as network natural gas use declines

We asked submitters whether the Government have a role in supporting vulnerable residential consumers as network natural gas use declines. Out of the 33 that responded, 30 agreed that the Government had this role.

Submitters gave a variety of suggestions of how the Government could support vulnerable consumers. The suggestions generally fell into two categories – measures to keep gas affordable for vulnerable consumers and measures to help vulnerable consumers switch to alternatives, or avoid getting stuck with gas in the first place.

Of those who called on the Government to keep gas affordable, some suggested the Government adapt regulation to protect vulnerable consumers from accelerating gas prices – one example given was the Australian Energy Regulator model (AER) which specifically considers energy affordability for vulnerable consumers. Some suggested the Government support pipeline cost and encourage consumers to keep their existing connections to facilitate a transition to renewable gas.

Those who called for measures to help vulnerable consumers avoid or move away from gas suggested that the Government should provide subsidies to help consumers meet the upfront capital costs of electrifying, and introduce incentives or requirements for owners of rental properties to upgrade to electric appliances like heat pumps. Submitters suggested subsidies and incentives could be funded by increasing the cost of natural gas. A couple submitters suggested the Government ban new gas connections to avoid consumers getting stuck with high gas prices.

Other more general suggested measures included promoting energy efficiency to reduce residential energy consumption and supporting energy hardship programs.

Submitters generally believed that additional natural gas infrastructure should be funded by private investments only

We asked submitters how they thought any additional investments in gas infrastructure should be funded. Several submitters with a wide range of perspectives indicated that investments in gas infrastructure – particularly in production, pipelines and peakers – should be left to the private sector.

A few noted specific cases where government investment may be required, including support for gas storage and underwriting the commercial risk created by government decisions. Others were opposed to any kind of investment in gas infrastructure and argued that all investment should be focused on renewable alternatives.

Submitters felt that rather than providing funding, the Government should create investment confidence, as discussed above. For example, as one gas producer put it:

“Additional investment should be provided entirely by the private sector. The key to enabling that investment is clear and stable policy which will bring investor confidence. Government could underwrite longer term risks posed by Government decisions such as NZ Battery project.”

Gas and electricity

Chapter 2 of the Issues Paper also covered the relationship between natural gas and electricity.

Submitters expect gas to have an ongoing role in maintaining electricity security of supply

We asked submitters what role they saw for gas in the future electricity market. Many of those who responded saw gas as important for security of supply of electricity, at least in the short term, until sufficient renewable generation is built, with a role in peaking and firming, and during dry years. For example, according to Transpower:

“Gas-fired generation, together with other resources, has an important role for the transition as new renewable electricity generation comes online, networks are upgraded, and regulation and business models evolve. Gas-fired generation helps to meet security of supply (reliability of supply) and reduces use of higher emission fuels (eg coal).”

Submitters saw a diminishing role for gas in baseload generation but emphasised the need to maintain a flexible gas supply as an important part of electricity security of supply. Some submitters saw a need for additional measures to enable gas to play an increasingly flexible role in the electricity sector, including monitoring new contractual arrangements (swaptions[1]), and developing new gas peaking and storage infrastructure. Contact Energy was among those who expressed these views:

“As baseload thermal exits the market, a larger portion of gas demanded by the electricity sector will need to be flexible. Flexible supply is less attractive for upstream suppliers, making it harder to contract for, or at a much higher price.”

Greater investment may be needed to support the use of gas in peaking and firming

Some submitters felt that there needs to be ongoing investment in gas to ensure ongoing gas supply for electricity generation, including in gas fields and gas peakers. As mentioned above, some called for investment in gas storage to support flexible use of gas in peaking and firming.

Some submitters mentioned that many players do not have current plans to invest in gas infrastructure due to weak incentives and high risks to invest, including economic barriers, lack of social licence and ESG (environmental, social and governance[2]) requirements for projects. According to some submitters, previous government policy settings undermined investment in gas-fired generation, including the goal of 100% renewable electricity and the government-led battery project. They asked the Government to avoid proactively disincentivising use of gas and to carefully consider work on dry year solutions given the impact this will have on private sector investment.

Some submitters called on the Government to ensure incentives to invest in gas-fired electricity generation are sufficient to reflect the risk to security of supply. Some suggested reforms in the electricity sector which could encourage investment, such as requiring wind and solar users to bear the full cost of supply, including requiring them to have backup available. Some suggested the Government use regulations to provide greater certainty to the industry (eg minimum notice periods for closure of thermal plants). A few felt the Government should consider intervening in the market by unwriting risks beyond regular commercial risks involved in investments in gas assets.

Our reliance on gas for electricity generation should be reduced over time

Several submitters felt that, while gas may be necessary for peaking and firming, its role should decline over time, and it should have no role in baseload electricity generation. Some also felt that investment in gas fired electricity generation should be limited. Some submitters indicated that gas should have no role in the electricity system in the future and saw renewable gases or other forms of energy storage fulfilling the peaking, firming and dry year roles, allowing natural gas to be phased out entirely over time.

A few felt that the Government should intervene to phase out natural gas from the electricity market, or at least look at putting in place a process to only approve fossil fuel solutions where necessary.

Some submitters called for the Government to focus on supporting the development of renewable alternatives, such as biogas, to displace use of natural gas in electricity generation.

Gas generation may be important for electricity price stability and promoting further electrification

We also asked submitters whether they thought gas could play a role in providing price stability in the electricity market. Some submitters noted that electricity prices could increase without gas generation due to decreased competition and the higher costs of alternatives. They felt the Government should focus on the role of gas in the electricity system because of its importance for maintaining electricity affordability and reliability. A reliable and affordable renewable electricity supply would expediate consumer decisions to electrify, leading to lower emissions and lower overall energy consumption.

Renewable gases

Chapter 3 of the Issues Paper discussed the potential role of renewable gases, particularly biogas and green hydrogen, in reducing emissions from natural gas use.

Biogas can reduce some of the emissions from natural gas, but its importance depends on its availability and affordability

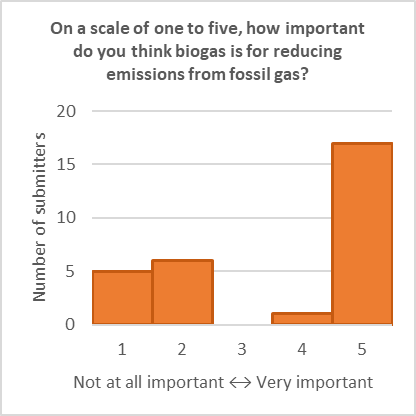

We asked submitters to rate the importance of biogas for reducing emissions from natural gas on a scale of 1 (not at all important) to 5 (very important). Out of 29 responses, 5 gave a rating of 1, 6 gave a rating of 2, 0 gave a rating of 3, 1 gave a rating of 4 and 17 gave a rating of 5. While these responses average out to a rating of around 3.7 out of 5, only one submitter gave a rating of 4 and none gave a rating of 3. Submitters were instead split between a majority who had high confidence in the potential for biogas to reduce emissions from natural gas, and a large proportion who did not see biogas as a very important solution.

Data for figure 1

Submitters who considered biogas to be important for reducing emissions from natural gas saw it as a less emissions-intensive alternative with low capital cost as there is no need to replace appliances or infrastructure. They saw it as an option which is currently technically and commercially viable. Some noted that further emissions reduction could be achieved if biogas is produced from waste diverted from landfills.

Those who did not see biogas as important agreed that it is less emissions intensive than natural gas, but believed it could only replace a small proportion of gas volumes due to feedstock scarcity and relatively high prices. Even those who were supportive of biogas uptake recognised that feedstocks would not be sufficient to completely satisfy current demand for gas – BusinessNZ Energy Council, for example:

“…agree[s] with the consultation document’s conclusion that biogas/biomethane has a promising role to play in reducing the emissions intensity of the gas sector over time. While full replacement of natural gas with biogas/biomethane is unrealistic over the short to medium term, there are immediate economic opportunities to progressively blend biogas or biomethane into the network for consumers willing to pay a premium.”

Biomethane could be used as a substitute for natural gas in the pipeline network

We asked submitters how they saw biogas being used as a substitute for natural gas. Many who responded felt that the best way to use biogas would be to upgrade it to biomethane and blend it into the gas pipeline network.

Submitters promoted this strategy because it would make use of existing infrastructure, allow consumers with sunk capital in gas equipment to decarbonise without additional capital spend, and would make the transition less disruptive by delaying the requirement to phase out gas.

Biogas could be prioritised as a substitute for natural gas in hard-to-abate applications

Several submitters felt that biogas would be of more value as a substitute for natural gas in harder-to-abate applications, such as peaking and firming in electricity generation or as a replacement feedstock for methanol manufacture. They felt that electrification should be prioritised for most applications of natural gas and were concerned that blending biomethane into pipelines would only perpetuate natural gas consumption in uses where alternatives exist, such as in residential cooking and heating.

Hydrogen might be a suitable substitute for natural gas only in specific hard-to-abate applications

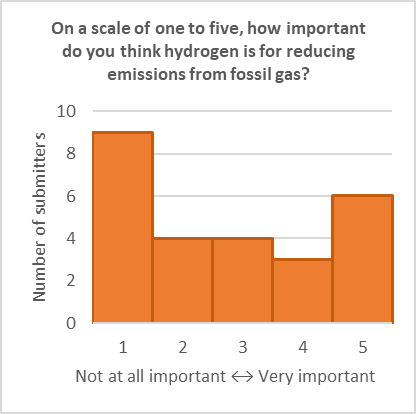

We asked submitters to rate the importance of hydrogen for reducing emissions from natural gas on a scale of 1 (not at all important) to 5 (very important). Out of 26 responses, 9 gave a rating of 1, 4 gave a rating of 2, 4 gave a rating of 3, 3 gave a rating of 4 and 6 gave a rating of 5. This mixed response averages out to a rating of around 2.7 out of 5, which is relatively low compared to biogas – the majority of submitters rated the importance of hydrogen as 3 or less, and the most common rating was 1.

Data for figure 2

Those that saw hydrogen as an important substitute for natural gas generally favoured it because it is a zero-emissions fuel when produced with renewable electricity, or extracted from naturally occurring reserves. Several believed that hydrogen would be very important in specific applications, particularly methanol, ammonia and steel manufacture, where electrification is not an option. Some saw an opportunity for blending a small amount of hydrogen into the gas pipeline network. These submitters generally saw it as a good option in the long-term, particularly when we reach the limit of our biogas supply.

Those who did not consider hydrogen to be important believed its contribution to emissions reduction would be insignificant in the foreseeable future because it would be relatively expensive and incompatible with existing infrastructure. Several pointed out that converting methane or electricity to blue or green hydrogen for use as a thermal fuel is extremely inefficient when compared to direct use of these energy sources. Some were concerned that hydrogen blending in pipelines would prolong natural gas consumption.

In their responses to questions on hydrogen, several submitters recognised that green hydrogen may become easier and cheaper to produce over time and emphasised the importance of timeframes. While most did not see immediate opportunities to replace natural gas with green hydrogen, and many doubted such opportunities would arise in time to contribute to the net-zero by 2050 target, some described strategies which could help develop a market for hydrogen. For example, some suggested blue hydrogen as an immediate opportunity for decarbonising ammonia and methanol production while making a full transition to green hydrogen in the long term. NZSteel envisioned a transition pathway where coal is replaced with natural gas as the reductant in steel production, followed by a transition to green hydrogen when the infrastructure exists.

The Government could implement enabling policies to accelerate uptake of low emissions gases

Many submitters saw a role for Government in accelerating uptake of renewable and low emissions gases. They gave several suggestions of policies the Government could introduce, including reforms to the ETS, development of renewable gas certification and development of a renewable gas mandate. Submitters believed that these policies could be used to lower costs and build scale to the point where renewable gases could meaningfully substitute for natural gas.

There was some suggestion of Government subsidies or tax credits, although submitters indicated these would need to be implemented carefully to avoid unintended consequences. Some submitters suggested that Government provide funding for studies into development of alternative gases.

Several felt that waste management strategies were important for promoting biogas uptake. Suggestions included strengthening regulations to divert organics away from landfills into biogas production and introducing policies which enable land use change for biofuel and biogas feedstocks. Submitters called for a more integrated approach between local councils, MBIE and the Ministry for the Environment in the development of such policies.

Submitters had diverging views on the importance of a renewable gas trading scheme

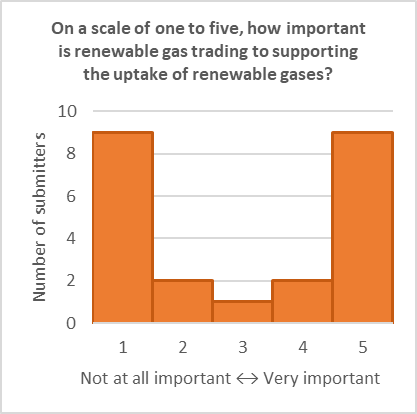

We asked submitters to rate, on a scale of 1 (not at all important) to 5 (very important), the importance of renewable gas trading to supporting the uptake of renewable gases. Out of 24 responses, 9 gave a rating of 1, 2 gave a rating of 2, 1 gave a rating of 3, 2 gave a rating of 4 and 9 gave a rating of 5. This equal split between extreme high and low rankings (resulting in an average of around 3 out of 5) showed that there is no consensus view on the importance of renewable gas trading.

Data for figure 3

Those who attributed high importance to renewable gas trading saw renewable gas trading as a way for a wider range of consumers to access the environmental benefits of renewable gases via virtual decarbonisation. They believed the resulting growth in the market would facilitate investment into renewable gases, assist renewable gas projects to being commercially viable, decrease renewable gas prices and provide the necessary economic incentives for their uptake.

Those who did not attribute importance to renewable gas trading raised concerns around the practicalities of implementing such a scheme. Some believed the scheme would be difficult to implement because renewable gases are likely to be blended with natural gas making it difficult to distinguish where emissions reductions should be recognised. Some were concerned that if not implemented correctly the scheme would not lead to meaningful emissions reductions and instead be used as a form of greenwashing. Some did not think the scale of the New Zealand market was large enough to warrant such a scheme.

There was little consensus on the preferred design for a renewable gas trading scheme

Views on whether the Government has a role in supporting a renewable gas trading scheme were mixed. Some submitters were of the view that Government should administer the scheme so that it is independent. A couple suggested the Gas Industry Company should administer it. Others said that any scheme should be developed by industry and administered independent of government, and only be approved and endorsed by government.

Some submitters mentioned gaps in existing international schemes and suggested that New Zealand take lessons and develop a bespoke scheme that reflects the domestic market. Other submitters thought it was more important that New Zealand adopt already existing internationally recognised schemes.

Coordination is important for the development of a renewable gas market

Many submitters recognised that coordination across Government departments as well as industry is required to ensure the development of a well-functioning renewable gas market and saw a role for Government in facilitating this coordination. This role could include mapping potential supply and demand across regions and connecting stakeholders.

Carbon Capture, Utilisation and Storage

Chapter 3 of the Issues Paper also discussed the potential role of carbon capture, utilisation and storage (CCUS) in reducing emissions from gas use.

CCUS may have a limited role in reducing emissions from natural gas use

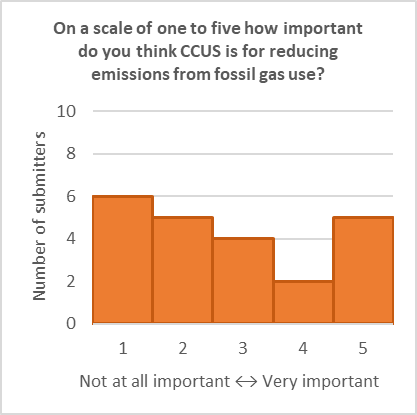

We asked submitters to rate the importance of CCUS in reducing emissions from natural gas use on a scale of 1 (not at all important) to 5 (very important). Out of the 22 responses, 6 gave a rating of 1, 5 gave a rating of 2, 4 gave a rating of 3, 2 gave a rating of 4 and 5 gave a rating of 5. This mixed response averages out to a rating of around 2.8 out of 5.

Data for figure 4

Of those submitters who saw some kind of role for CCUS (ie gave a rating higher than 1), most shared a view that it would only be important for a few specific hard-to-abate applications, particularly the application in gas extraction as discussed in the Issues Paper. Other heavy emitters which submitters identified as potential beneficiaries of CCUS included petrochemical producers, NZ Steel and thermal power stations.

The variety of ratings largely reflected a variety of views around whether gas extraction and industrial use would remain important. Several expected the gas market to decline and therefore saw CCUS as a low priority. However, some saw potential in CCUS for renewable alternatives such as geothermal power plants and biomethane plants.

Those submitters who did not see a role for CCUS generally expressed the view that it was unproven outside of the context of gas extraction, and therefore was not important because the priority should be to produce and use less gas.

Cost is one of the greatest barriers to CCUS

Many submitters expressed concerns that CCUS would be expensive – both the initial investment in infrastructure and the ongoing operational, monitoring and insurance costs. They noted that high point source emissions are needed to justify investment and that the economics were unproven except in the case of CO2 reinjection at gas fields. Several submitters with a wide range of perspectives were concerned about cost, including the large industry players who would benefit the most.

A couple of submitters mentioned that the limited number and geographic distribution of our point source emissions and candidate reservoirs means we may not reach sufficient economy of scale to justify the costs, even if resources are pooled into a shared CO2 transport and storage system.

Some were concerned that CCUS could divert resources (money and energy supply) from a transition to renewable energy and that CCUS infrastructure would become stranded assets if the fossil fuel industry declined.

Regulatory barriers will need to be addressed if we want to pursue CCUS

Several of the submitters who were supportive of CCUS agreed that regulatory changes would be needed to enable it. A couple of submitters explicitly said they supported the changes recommended in the report by Professor Barry Barton[3] which was referenced in the Issues Paper. Some wanted to see more ambitious changes such as the introduction of a standalone Act for CCUS. Pressing issues which were highlighted by several submitters included that current ETS settings do not incentivise CCUS, and that New Zealand is missing a regulatory framework for CO2 sequestration and transport. The general lack of regulatory certainty was seen as an issue.

If we pursue CO2 storage, we need to ensure it will remain in the ground long-term

Several submitters expressed concerns that CO2 injected into depleted oil and gas reservoirs could escape. Expected causes included New Zealand’s seismic activity or induced seismicity caused by CO2 injection. Submitters recognised that the main risk of leakage was the climate impact of the additional emissions. One also mentioned that if a large amount escaped at once there may be risk of suffocation in the surrounding area.

While some were confident that the risks would be minimal if established gas field practice was followed, some noted that it was not clear who would be responsible for the stored CO2 in the long term as there is currently no regulatory program regarding liability. Some submitters were concerned that the liability could end up on the Government and on future generations.

Some submitters proposed technological solutions to minimise the risk of leakage. These submitters explained that certain kinds of rock combine with CO2 to form minerals (carbonates) which if present could lower the risk of leakage from geological formations. Some also highlighted that there is research into the possibility of mining these rocks and using CO2 mineralisation as an alternative to storage in reservoirs.

Submitters had distinct views on storage versus utilisation of CO2

Several submitters did not see CO2 storage as a permanent solution. They considered CO2 to be valuable and felt that it should be used rather than disposed of. Suggested uses included current commercial applications (eg drinks and horticulture), or as an alternative carbon feedstock for methanol, methane and other products.

A few mentioned that if captured CO2 were utilised, rather than stored, it is not net-zero because emissions are eventually released. A couple noted that net-zero fuels could be produced from captured carbon if the CO2 comes from biomass. For example, Fonterra suggested that:

“Huntly Rankine units could theoretically be run on biomass with carbon capture technology to produce synthetic methane with hydrogen electrolysis for pipeline injection.”

Some submitters were specifically opposed to storage of CO2, including iwi – particularly Te Rūnanga o Ngāti Mutunga and Ngā Iwi o Taranaki – who expressed strong views against re-injecting emissions into depleted reservoirs (see section on Iwi and Māori views for more detail).

There is a risk that CCUS would prolong natural gas use and associated emissions

Several submitters expressed concerns that CCUS, especially if primarily applied to oil and gas extraction, could allow oil and gas operations to extract more, prolonging dependency fossil fuels and the associated emissions. This view was expressed by Oxfam, among others:

“Even when CCUS projects work as intended, they only capture the emissions from extraction of oil and gas and do nothing to prevent the much larger emissions that result from burning the fossil fuels.”

Further concerns included that CCUS may not be as effective at capturing emissions as anticipated and that CCUS could consume large amounts of energy, increasing overall energy demand and delaying the transition to renewables.

Others were willing to tolerate this risk because they saw no alternative to CCUS in the face of global warming, particularly considering messaging from the Intergovernmental Panel on Climate Change in their 2023 report which calls for CCUS deployment to be sped up to help the world limit global warming to 1.5-2°C. The Major Gas Users Group put it this way:

“Early emission reduction is more important than waiting for the perfect solution.”

Options to increase capacity and flexibility of gas supply

Finally, Chapter 3 of the Issues Paper discussed the potential role of gas storage and LNG importation to increase capacity and flexibility of gas supply.

Gas storage can support the transition to a low emissions economy

We asked submitters what role they saw for gas storage as we transition to a low-emissions economy. 117. Some submitters emphasised the benefits of gas storage in a situation where the number of gas producers and producing fields declines, and existing fields continue to age and become depleted. Benefits listed included avoiding gas shortages and price volatility associated with reduced production – eg it can cover maintenance outages in a more concentrated supply market, and holding excess gas if major users have outages.

Many submitters highlighted the role that gas storage could play in the electricity system, and its importance for supporting electricity peaking and firming if the proportion of variable renewable generation increases.

However, some mentioned that gas storage is only useful for as long as we have sufficient long-term gas supply, and therefore it should be considered alongside other security of supply options.

The importance of increasing gas storage capacity depends on the demand profile

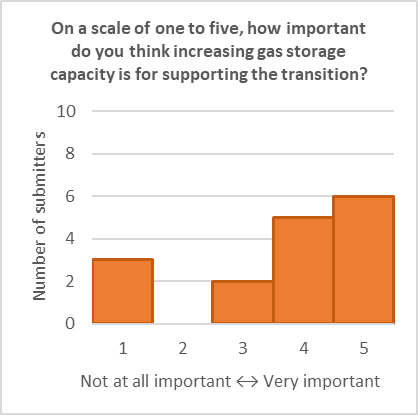

We asked submitters to rate, on a scale of 1 (not at all important) to 5 (very important), the importance of increasing gas storage capacity for supporting the transition. Out of the 16 responses, 3 gave a rating of 1, 0 gave a rating of 2, 2 gave a rating of 3, 5 gave a rating of 4 and 6 gave a rating of 5. This response averages out to a rating of around 4 out of 5, reflecting that the majority of those who responded considered increasing gas storage capacity to be important.

Data for figure 5

Those submitters who considered increasing gas storage capacity to be important (ie gave it a rating greater than 1), expected that peak gas demand would remain high due to its continued use in thermal electricity generation for peaking and dry year cover. They saw it to be especially important in the absence of any new gas discoveries.

Those who did not consider increasing gas storage capacity to be important expected gas demand for petrochemical and electricity generation to decline to the extent that additional storage capacity would have limited value. They felt that existing storage should be sufficient to maintain a reliable supply in a declining gas market, as more storage capacity would become available in existing storage and pipeline infrastructure.

Storage could be used for renewable gases

Some submitters felt that storage facilities, such as depleted gas fields, should be used to store renewable gases, including biomethane, synthetic natural gas and blended hydrogen, not just natural gas.

Ideally, the government should not have a direct role in the gas storage market

The majority of submitters felt that, ideally, the government should leave it to the market to find the optimal gas storage arrangement. However, they called on the Government to clearly signal its policy direction and appropriately use established market mechanisms such as the ETS to guide investment decisions. They expressed different views on what the guiding policy direction should be – support for continued gas supply or a rapid transition away from gas.

The Government may need to support investments in storage

Some submitters felt that if the Government pursues a rapid phase out of gas, they may need to support or buy out investments in gas storage to make up for the lack of an ongoing business case. A few suggested that Government investment in gas storage may be justified because it would have substantial public benefits.

A minority believed that the Government should instead invest in alternative, low emissions energy storage solutions.

Most submitters did not support LNG importation

We asked submitters whether they agreed that LNG importation is not a viable option for New Zealand. Out of the 24 submitters who responded, 16 explicitly expressed agreement that LNG importation is not a viable option, 5 did not explicitly agree with the statement but were clearly unsupportive of LNG import and 3 either explicitly disagreed or showed support for LNG import.

The reason given by several submitters for why they did not see LNG import as a good solution for New Zealand was because they saw it as unnecessary. They expressed the view that New Zealand has a sufficient domestic supply of natural gas or that New Zealand could instead phase out natural gas and replace it with renewables.

Several submitters did not consider LNG import the best available option because they believed it would have relatively poor outcomes for the energy trilemma – ie energy affordability, emissions and security. They expected imported LNG would be more expensive than domestic gas, and would require large investment in infrastructure without benefits to local economy and employment. They also expected imported LNG would have higher emissions intensity than domestic supply and saw security of supply risks associated with relying on imported LNG due to distance from suppliers and competition with larger markets.

Some pointed to gas storage is a better option, which could provide additional system flexibility at a lower cost.

Submitters saw risks if New Zealand’s gas markets were tethered to the international price of gas. They expected that it would lead to higher and more variable gas prices, and that the price increases and volatility would make it difficult for major gas using industries to compete internationally, leading to de-industrialisation and reliance on imported products. They also expressed concerns that price escalation and volatility could flow through to electricity markets.

Reasons given by the few that saw a role for LNG importation were that it could provide a small scale and flexible option to support energy security and that it would be cheaper than some other options proposed by the Government, such as the Lake Onslow pumped hydroelectric scheme. A couple of submitters suggested that imported gas could become competitive with domestic gas as domestic production declines and international prices stabilise. However, even these submitters expressed a preference for using domestic gas supply, rather than relying on imports.

Footnotes

[1] A swaption (also known as a swap option) is an option contract that grants its holder the right, but not the obligation, to enter into a predetermined swap. Power companies have used a system of swaptions to reserve back-up thermal power supplies if they run short with the advantage of providing long-term energy price guarantees.

[2] Environmental, social and governance (ESG) refers to a collection of non-financial corporate performance evaluation criteria that investors use to assess the performance of a company in in terms of its sustainability and social responsibility.

[3] Carbon Capture and Storage: Taking Action under the Present Law, University of Waikato, 2022