Breadcrumbs

Home ›

Building and energy

›

Energy and natural resources

›

Energy and resources consultations and reviews

›

A draft Minerals Strategy for New Zealand to 2040

...

›

The sector’s role in our economy is important, now and into the future

-

Energy and resources consultations and reviews

- Review of electricity market performance

- Amendments to the Electricity Safety Regulations to expand the permitted voltage range for electricity supply

- Improving our diesel resilience

- A draft critical minerals list for New Zealand – Summary

- A draft Minerals Strategy for New Zealand to 2040

- 2024 Proposed amendments to the Crown Minerals Act 1991

- Consultation document: Advancing New Zealand’s energy transition

- 2020-23 Review of the Crown Minerals Act 1991

- Investigation into electricity supply interruptions of 9 August 2021

- Electricity Price Review

- 2018-2019 Electricity Price Review

- 2017 energy consultations and reviews

- 2016 energy consultations and reviews

- Older energy consultations and reviews

The sector’s role in our economy is important, now and into the future

Our current minerals production is valuable and benefits New Zealanders.

On this page

The production of our minerals resources currently benefits New Zealanders in a range of ways. The sector creates high paying jobs training and education opportunities, community investment, and momentum for local service businesses.

This helps to diversify regional economies – especially in areas that rely heavily on agriculture, dairy, forestry or fishing – making

them less vulnerable to external economic factors. The minerals sector can continue to yield these economic benefits to

New Zealand now and into the future as part of a holistic economic and resource ecosystem.

Around half of mining activity involves production of Crown-owned minerals where royalties are generated. This substantial revenue stream contributes to funding our roads, healthcare, and education.

Major minerals areas and industry statistics

Industry statistics text description

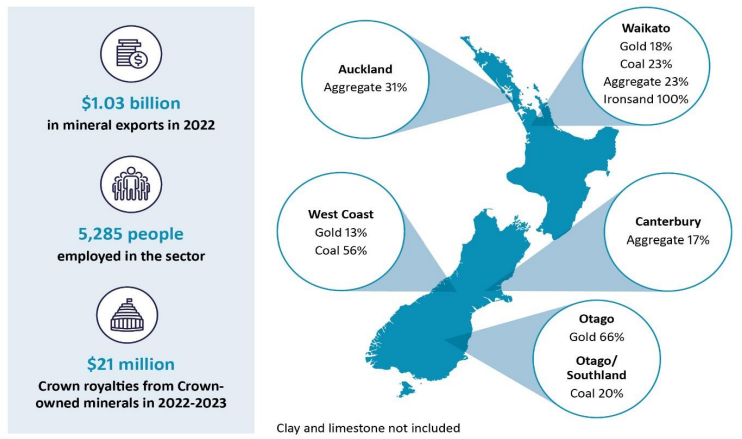

Industry statistics

- $1.03 billion in minerals exports in 2022

- 5,285 people employed in the sector

- $21 million crown royalties from Crown-owned minerals in 2022 to 2023

Major minerals areas text description

Major minerals areas

| Area | Mineral | Percentage |

|---|---|---|

| Auckland | Aggregate | 31% |

| Waikato | Gold | 18% |

| Coal | 23% | |

| Aggregate | 23% | |

| Ironsand | 100% | |

| West Coast | Gold | 13% |

| Coal | 56% | |

| Canterbury | Aggregate | 17% |

| Otago | Gold | 66% |

| Otago and Southland | Coal | 20% |

Growth will be underpinned by scaling up our existing exports and by realising new mineral opportunities

Our existing exports are mainly gold and coal for steelmaking. These will remain relevant and the backbone of our sector,

but we also have the opportunity to unlock potential from our wide and varied mineral endowment. This includes

opportunities for extraction, alongside the production of minerals in other ways, such as through recycling efforts.

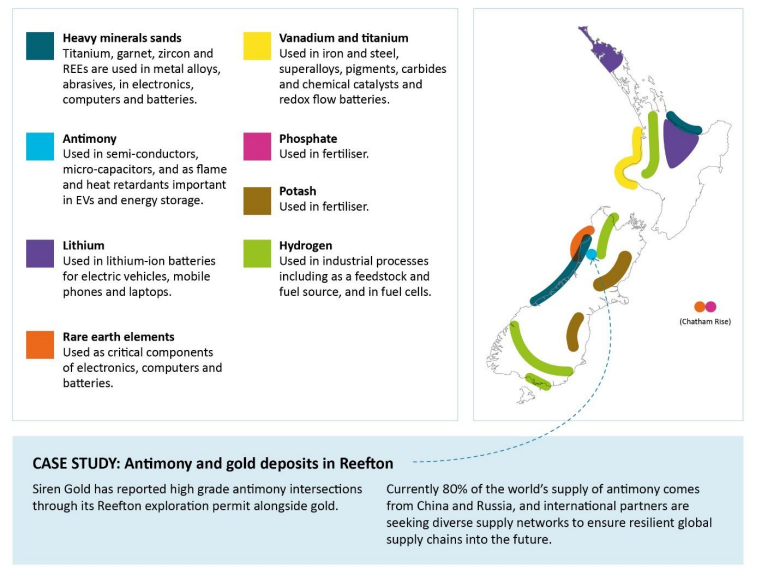

New mineral opportunities

Based on permit data, private mineral exploration and inferred from the geology of the area.

New minerals opportunities

| Type of mineral | Uses | Locations |

|---|---|---|

| Heavy mineral sands such as titanium, garnet, zircon and REEs | Metal alloys, abrasives, electronics, computers and batteries. | Bay of Plenty and West coast |

| Antimony | Semi-conductors, micro-capacitors, flame and heat retardants in EVs and energy storage. | Reefton |

| Lithium | Lithium-ion batteries for electric vehicles, mobile phones and laptops. | Northland and Bay of Plenty |

| Rare earth elements | Critical components of electronics, computers and batteries. | Chatham Rise |

| Vanadium and titanium | Iron and steel, super-alloys, pigments, carbides and chemical catalysts and redox flow batteries. | Waikato and Taranaki |

| Phosphate | Fertiliser | Chatham Rise |

| Potash | Fertiliser | Canterbury |

| Hydrogen | Industrial processes including feedstock and fuel source and in fuel cells. | Southland, Nelson-Tasman and Waikato. |

Case study: Antimony and gold deposits in Reefton

Siren Gold has reported high grade antimony intersections through its Reefton exploration permit, alongside gold.

Currently 80% of the world's supply of antimony comes from Russia and China, and international partners are seeking diverse supply networks to ensure resilient global supply chains into the future.