Option 2: Increase the stockholding obligation for diesel from 21 days’ cover to 28 days’ cover

The MSO will require fuel importers to hold, on average, 21 days’ cover of diesel from 1 January 2025.

On this page

The stockholding levels can be adjusted through regulations – either up or down – for particular fuels. Under this option, the MSO for diesel would increase from 21 to 28 days’ cover. Fuel importers would need to increase their diesel stockholding to meet the increased obligation, putting the onus of improving diesel resilience fully on fuel importers.

Impacts on competition

Larger fuel importers would likely find it easier to comply with an increased obligation. As they have access to more sites with more storage options, they have more capacity to take more frequent fuel cargoes and therefore smooth out their stock fluctuations. These larger fuel importers also have some existing shared fuel storage infrastructure, while smaller fuel importers could find it challenging to enter into agreements to access such infrastructure. During public consultation in 2022, the fuel sector raised concern about the impacts of a significantly higher minimum stockholding obligation on competition in the fuel markets.

Consultation question 8

8. If we increased the MSO for diesel to 28 days, how can we maintain competition in the fuel industry?

Cost impact

This is a low-cost option for the Crown but is likely to be the highest cost option to consumers at the pump. Fuel importers will likely pass on the costs of additional diesel and its storage. Disproportionate impacts to smaller players could also reduce competition in the sector and cause higher costs to consumers overall.

Estimates from one fuel importer during the 2022 consultation suggested costs to consumers at the pump could increase by an additional 0.4 to 2 cents per litre. We have not independently verified these estimates. In addition, the cost of increased diesel stockholding and storage is likely to be different for each fuel importer depending on how they decide to meet the increased obligation. This makes it difficult to estimate flow on costs.

Consultation question 9

9. Do you have any information on how much an increased MSO for diesel could cost consumers? Please provide details and explain how any estimates have been arrived at (if applicable).

Administrative efficiency and timing

This option is consistent with the MSO regime and avoids the complexity of establishing and administering a parallel solution. It is a low burden option for the Crown. We would need to adjust the MSO, but that can be done relatively easily and quickly via regulations.

However, there would be a higher burden on fuel importers. While importing and storing fuel before it is sold is a fuel importer’s core business, fuel importers would need to decide how to incorporate the additional stock into their day-to-day business. They would also need time to acquire additional storage, either through new build or by converting existing tanks.

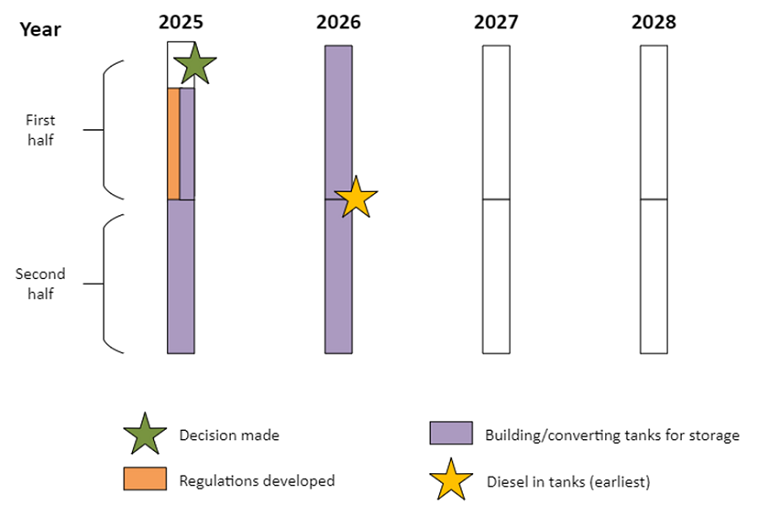

Figure 1 illustrates an indicative timeline for this option. Assuming a decision is made by the beginning of 2025, a further 18 months to two years would be available for fuel importers to access additional storage. Therefore, we estimate that tanks could be filled with diesel to meet the increased obligation from mid-2026.

Read diagram description – Figure 1: Indicative timelines for Option 2

Consultation questions 10 and 11

10. How quickly could fuel importers meet an increased MSO? What could be done to get diesel in tanks earlier than 2026?

11. We have assumed that fuel importers will begin planning for an increased MSO as soon as it is announced, rather than wait until regulations are made. Is this a fair assumption?