Option 4: Increase the stockholding obligation for diesel as in Option 2 but the government supports new additional storage

As with Option 2, under this option the MSO would increase to 28 days.

On this page I tēnei whārangi

However, under Option 4, the government would provide financial support to the industry to help alleviate flow on costs to end consumers. Project proposals would have to meet certain criteria to ensure they are aligned with the overall objectives of the fuel resilience policy package.

This is the approach Australia took. Australia provided matching grants (up to 50% for each project) totalling AU$227 million for 8 additional storage projects through its ‘Boosting Australia’s Diesel Storage Program’. Approved projects were required to be completed by 30 June 2024.

Impacts on competition

This option could also reduce competition, as smaller fuel importers have less capacity to take more frequent fuel cargoes at least until they invest in extra storage. Grants or other financial support could help smaller fuel importers invest and meet an increased MSO. It is also possible that smaller fuel importers could find it more challenging to find new storage sites, while major fuel importers have readily available opportunities to build extra storage at Marsden Point.

Cost impact

The main benefit of this option is that it would likely reduce costs to consumers by alleviating costs to the fuel sector. The Government would also have better oversight of the commercial details of projects it funds, providing more information about what drives fuel prices.

In terms of costs to the Government, we could explore options to fund a grant programme under this option. This could include using the Levy funds, which would be paid for by consumers of fuel (the Levy partially makes up the fuel price). The Levy rate may or may not have to be raised, depending on the future cost of the financial support for diesel storage projects and other Levy-funded programmes (which is uncertain due to fluctuations in the cost of IEA oil tickets). We could seek separate funding for the scheme, which would involve paying for it out of general taxation. This could also be appropriate given all New Zealanders would benefit from improved diesel resilience in the case of a supply shortage or emergency, not just a smaller group of Levy payers.

Administrative efficiency and timing

As with Option 2, the MSO can be adjusted relatively easily and quickly via regulations. The Government would need to secure funding to provide financial support for diesel storage projects. Once a grant scheme is set up, the Government would have to assess project proposals and award funding.

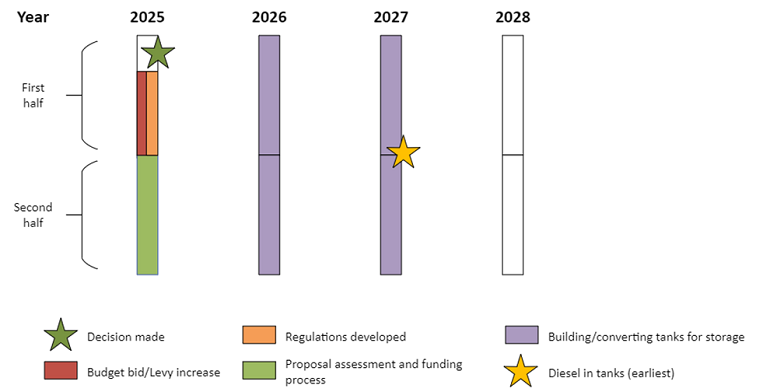

A further year and a half to two years would be required for fuel importers to access additional storage, potentially longer if new build tanks are required. Therefore, we estimate that tanks could be filled with diesel to meet the increased obligation from 2027 to 2028.

Figure 3 illustrates an indicative timeline for this option.

Figure 3: Indicative timelines for Option 4

Read diagram description – Figure 3: Indicative timelines for Option 4

Consultation questions 14 to 17

14. Do you think the government should provide fuel importers with financial support to help alleviate flow on costs to consumers? Why or why not?

15. In your opinion, what kind of financial support would be appropriate?

16. What proportion of government funding would noticeably reduce an increase to fuel prices?

17. Should the government recover the cost of financial support through raising levy from fuel consumers?