Modernising the Companies Act 1993 and making other improvements for business

This page sets out background information on a package of reforms of the Companies Act and related corporate governance legislation

On this page I tēnei whārangi

Changes to corporate governance legislation

On Monday 5 August 2024, the Government made decisions to progress a package of reforms to help make sure the rules governing companies are clear, workable and fit for purpose.

These reforms are the first step in a phased approach to make improvements to New Zealand’s company law. More detail on this first phase of reform is available below.

The second phase of reforms will start with a review by the Law Commission of directors’ duties and related issues of director liability, sanctions, and more effective enforcement. This stage will look at the issues raised in the Mainzeal case, among other matters. It is expected that the Commission will commence its work in 2025.

Read the Government's announcement:

Improving fairness and ease of doing business(external link) — Beehive.govt.nz

You can read the news item on the Law Commission’s website here:

Law Commission to undertake project on directors’ duties(external link) — Te Aka Matua o te Ture | Law Commission

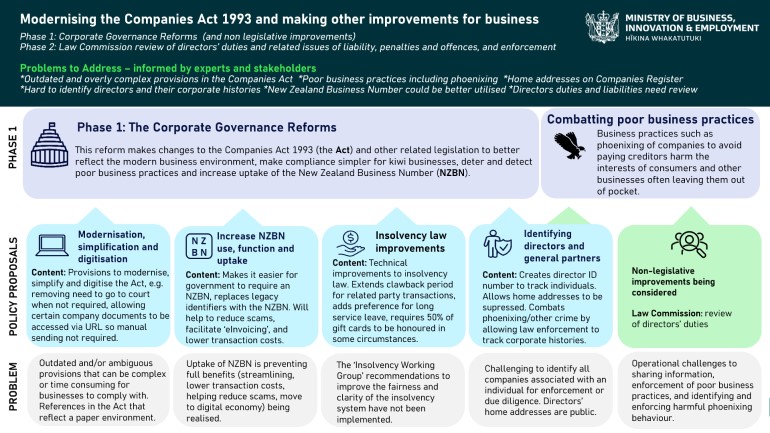

Diagram: Changes to corporate governance legislation

What the reforms cover

The Companies Act governs how the 730,000 companies in New Zealand are established, operated, and dissolved. The Act is now more than 30 years old, although it has been amended over that time. While in many respects it’s still fit for purpose, the Government is looking to make targeted improvements to benefit businesses and the New Zealand economy.

The package of reforms will address issues with New Zealand’s company law. The reforms will:

- Modernise, simplify and digitise the Companies Act. These changes will better reflect the modern business environment and make the best use of modern technology by addressing out-of-date, ambiguous or overly complex elements of the Companies Act. They will help reduce compliance costs for companies and the regulator.

- Introduce a unique identifier for company directors and general partners. This will help with identifying and enforcing poor and illegal business practices, including phoenixing, by making it easier to identify all the companies a director is associated with. It will also permit directors and shareholders to replace their residential addresses with an address for service on the Companies Register. This will address the safety and privacy concerns that directors and shareholders have about their home addresses being publicly available.

- Improve outcomes for creditors. These changes to insolvency law follow the recommendations of the Insolvency Working Group (which was set up in 2015 to look into aspects of New Zealand’s insolvency law). They include extending the period during which transactions with related parties can be voided to four years when a business is insolvent.

- Improve uptake and use of the NZBN. These changes will make it easier for businesses to connect and transact with each other and the government using the NZBN. For example, they make it easier for government agencies to require a NZBN, and enable other MBIE corporate registers to update information using publicly available data from the NZBN register.

More information on the proposals relating to unique identifiers, directors’ addresses and the insolvency law reform proposals can be found here:

Supporting the integrity of the corporate governance system

Insolvency Review Working Group

This package of reforms does not include creating a Beneficial Ownership Register. We will provide an update on this project in due course.

Cabinet papers and other documents

The Cabinet paper and accompanying appendices, including the Regulatory Impact Statements can be found below:

-

Modernising the Companies Act 1993 and Making Other Improvements for Business [PDF 829KB]

Modernising the Companies Act 1993 and Making Other Improvements for Business [PDF 829KB]

-

Modernising the Companies Act 1993 and Making Other Improvements for Business – Minute of Decision [PDF 353KB]

Modernising the Companies Act 1993 and Making Other Improvements for Business – Minute of Decision [PDF 353KB]

-

Appendix 1: Proposals in the Companies Act, Limited Partnerships Act, and Insolvency Act with a Regulatory Impact Analysis Exemption [PDF 234KB]

Appendix 1: Proposals in the Companies Act, Limited Partnerships Act, and Insolvency Act with a Regulatory Impact Analysis Exemption [PDF 234KB]

-

Appendix 2: Amendments to RSB 3 proposals [PDF 214KB]

Appendix 2: Amendments to RSB 3 proposals [PDF 214KB]

-

Appendix 3: Regulatory Impact Statement: Companies Act 1993 Modernisation and Simplification Changes [PDF 344KB]

Appendix 3: Regulatory Impact Statement: Companies Act 1993 Modernisation and Simplification Changes [PDF 344KB]

-

Appendix 4: Regulatory Impact Statement: Making it easier for government agencies to require an NZBN [PDF 256KB]

Appendix 4: Regulatory Impact Statement: Making it easier for government agencies to require an NZBN [PDF 256KB]

-

Appendix 5: Better Visibility of Individuals Who Control Companies and Limited Partnerships – Minute of Decision [PDF 195KB]

Appendix 5: Better Visibility of Individuals Who Control Companies and Limited Partnerships – Minute of Decision [PDF 195KB]

-

Appendix 6: NZBN legislative proposals – additional detail [PDF 187KB]

Appendix 6: NZBN legislative proposals – additional detail [PDF 187KB]

-

Appendix 7: Business registers and associated legislation in scope for NZBN changes [PDF 79KB]

Appendix 7: Business registers and associated legislation in scope for NZBN changes [PDF 79KB]

On 31 March 2025, the Government agreed to a small number of additional policy decisions consistent with the objectives of the overall package of reforms:

Have your say

The public will be able to submit on the legislation as it progresses through Select Committee stage. This will be through Parliament’s website once the Bill is introduced in the second half of 2025.