Employment Relations Act 2000 amendments

The Employment Relations Act 2000 will be amended to clarify contracting arrangements, simplify personal grievances and reduce complexity at the start of employment relationships.

The Government has reintroduced the ability to make pay deductions in response to partial strikes.

On this page

Providing greater certainty for contracting parties

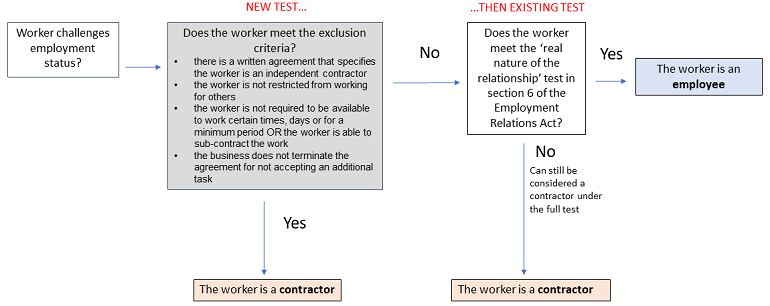

The Employment Relations Amendment Bill contains a gateway test providing greater certainty for businesses and workers who use contracting arrangements meeting specified criteria. This will give greater weight to the intention of contracting parties and support labour market flexibility.

The Bill amends the definition of employee in section 6 of the Employment Relations Act 2000 to exclude ‘specified contractors’. Working arrangements which meet the criteria for a ‘specified contractor’ will not be considered to be employment and will not be subject to the existing ‘real nature of the relationship’ test in section 6 of the Employment Relations Act 2000.

Section 6 – Employment Relations Act 2000(external link) — New Zealand Legislation

All 4 of the following criteria must be met for a worker to be considered a specified contractor:

- there is a written agreement that specifies the worker is an independent contractor; and

- the worker is not restricted from working for others; and

- the worker is:

- not required to be available to work certain times, days or for a minimum period; OR

- able to sub-contract the work, and

- the business does not terminate the arrangement, if the worker does not accept an additional task.

The hiring business must give the worker a reasonable opportunity to seek advice on the written agreement before signing it and has the option to undertake vetting of subcontractors, where due diligence is necessary to meet statutory obligations.

Working arrangements that do not meet the test for a specified contractor will continue to be assessed using the 'real nature of the relationship' test in section 6 of the Employment Relations Act 2000.

The diagram below explains how this will work.

Once the provisions are in place, the test for a specified contractor will be considered by the Employment Relations Authority when deciding claims that a worker is an employee and not a contractor. If the working arrangement meets the 4 criteria set out in the test, the worker is considered to be a contractor. If any of the 4 criteria are not met, the claim would be considered under the existing ‘real nature of the relationship’ test.

Read image transcript:

These amendments are part of the National-ACT coalition agreement commitment to give greater weight to the intention of contracting parties, where 2 parties enter a contract for services.

Read the Minister’s announcements:

Increased certainty for contractors coming(external link) — Beehive.govt.nz

New Bill to boost labour market flexibility(external link) — Beehive.govt.nz

Changes to personal grievances

The Government has announced changes to set an income threshold above which a personal grievance could not be pursued and remove eligibility for remedies where the employee is at-fault.

Read the Minister's announcements:

More flexible dismissal process for high-income employees(external link) — Beehive.govt.nz

Removing rewards for poor employee behaviour(external link) — Beehive.govt.nz

Twelve months to re-negotiate contracts before income threshold policy takes effect(external link) — Beehive.govt.nz

Introducing an income threshold for unjustified dismissal personal grievances

The Employment Relations Act 2000 will be amended to introduce a high-income threshold for unjustified dismissal personal grievance claims.

This means that employees earning over the threshold will not be able to raise an unjustified dismissal personal grievance claim or an unjustified disadvantage claim when it relates to the dismissal. Employers and employees will be able to agree to opt back into unjustified dismissal protection before, or at any point during, the employment relationship.

The threshold will initially be set at $180,000 per annum of base pay, and will be updated annually

The high-income threshold will initially be set at $180,000 per annum of base pay. Base pay includes regular salary and wages, and excludes other income such as incentive payments, or benefits such as vehicle use.

The threshold will not be adjusted for part-time employment (i.e. an employee working 20 hours per week and earning $90,000 will not be considered above the threshold).

The threshold will be updated annually according to increases in average weekly earnings, as measured in Stats NZ Quarterly Employment Survey. See: User Guide for Stats NZ’s wage and income measures.

User Guide for Stats NZ’s wage and income measures [PDF 318KB](external link) — Stats NZ

Employers and employees can opt back into unjustified dismissal protection, as well as continue to negotiate their own dispute resolution processes

Employees earning over the threshold can continue to raise personal grievances on other grounds, for example discrimination, sexual or racial harassment, or union duress.

As well as being able to opt back into unjustified dismissal coverage, employers and employees can continue to negotiate their own employment dispute resolution processes into their employment agreement.

There will be a 12-month transitional period for employees on existing employment agreements

| This section was added on 12 February 2025 following the Minister for Workplace Relations and Safety’s confirmation of the transitional arrangements. |

The income threshold for unjustified dismissal personal grievances will apply to new employment agreements when the legislation comes into force.

There will be a 12-month transitional period for employees on existing employment agreements. During the transitional period, employees on existing employment agreements will retain the ability to raise an unjustified dismissal personal grievance. This is intended to provide an opportunity for employers and existing employees to negotiate appropriate terms and conditions before the income threshold applies, if they wish.

The transitional period for employees on existing employment agreements will end:

- if the employer and employee agree to vary their employment agreement to state the threshold applies before the end of the transitional period, or

- 12 months after the commencement date.

An employee is no longer on an existing employment agreement if they move to a new employer, or they shift to a new role within the same employer. However, if the employee shifts to a new role with the same employer as a result of a restructure, the transitional period will still apply.

An employer and employee agreeing to new terms and conditions within an employment agreement (unrelated to the threshold) will remain covered by the transitional period. For example, if an employer and employee agree to vary the employment agreement to change hours of work or work location, the transitional period will continue to apply.

Employees have 90 days from the end of their employment to raise an unjustified dismissal claim, unless the employer agrees to the personal grievance being raised, or the delay was due to exceptional circumstances.

If an employee is dismissed before the threshold applies, the employee will be able to raise an unjustified dismissal grievance within the 90-day period. For example, if an employee on an existing employment agreement is dismissed 10 days before the end of the transitional period, they will be able to raise an unjustified dismissal claim after the end of the transitional period, so long as it is within the 90-day period.

Changes to remedies

Under the current law, if a personal grievance is established, the Employment Relations Authority or Employment Court may grant one or more of the following remedies to the employee:

- reinstatement of the employee in their former position or in a position no less advantageous to them,

- the reimbursement of wages or other money lost as a result of the grievance (generally up to a maximum of three months of ordinary pay, with discretion for higher reimbursement), and/or

- compensation for humiliation, loss of dignity, and injury to the feelings (hurt and humiliation) of the employee, or the loss of any expected benefit.

The Employment Relations Act 2000 will be amended to strengthen consideration and accountability for the employee’s behaviour in the personal grievance process.

To achieve this, several changes will be made to the 3 key steps in the personal grievance process:

Step 1: When the Employment Relations Authority or Employment Court is deciding whether to establish a personal grievance:

- they will be required (in every case) to consider whether the employee’s behaviour obstructed the employer’s ability to meet their obligation to act as a fair and reasonable employer; and

- they will no longer be required to consider whether the employer’s procedural error meets the test of being ‘minor’. Instead, the focus will be on whether any errors in the employer’s process resulted in the employee being treated unfairly.

Read information on current employer obligations:

Fair process(external link) — Employment New Zealand

Step 2: When the Employment Relations Authority or Employment Court is deciding whether to award remedies:

- if it is determined that the employee’s behaviour amounts to serious misconduct, the employee will not be eligible for any remedies. Examples of serious misconduct include (but are not limited to):

- violent behaviour

- bullying

- sexual, racial or other harassment

- theft or fraud

- behaviour that endangers the health and safety of yourself or others

- using illegal drugs at work

- dishonesty.

- if it is determined that an employee’s behaviour contributed to the issue that gave rise to the personal grievance in any way, the employee will not be eligible to be reinstated into their role or receive any compensation for humiliation, loss of dignity, and injury to the feelings, or for the loss of any expected benefit.

Step 3: When the Employment Relations Authority or Employment Court are deciding whether to reduce remedies:

- the law will allow remedy reductions of up to 100 percent where an employee has contributed to the situation which gave rise to the personal grievance.

Changes to employers’ obligations when a new employee begins work

The Government is removing the requirement that if an employer has workers covered by a collective employment agreement, for the first 30 days of their employment, a new employee’s individual employment agreement must reflect the terms of the collective employment agreement (the 30 day rule), and any additional terms mutually agreed that are no less favourable to the employee than the collective employment agreement.

Employers and employees will be able to negotiate the terms and conditions of individual employee agreements at the start of employment which can differ from the collective employment agreement.

Employers will no longer have to give an ‘active choice form’ to the employee, and unions will no longer have the ability to provide information about the role and functions of the unions, that the employer must pass on to the employee.

Employers will still need to inform an employee:

- that a collective employment agreement exists and covers the work to be done by the employee,

- that the employee may join a union that is a party to the collective employment agreement,

- about how to contact the union; and

- that, if the employee joins the union, the collective employment agreement will bind the employee.

The employer must also continue to give the employee a copy of the collective employment agreement and if the employee agrees, inform the union as soon as practicable that the employee has entered into the individual employment agreement with the employer.

Read the Minister’s announcement:

Cutting red tape at the start of employment(external link) — Beehive.govt.nz

Pay deductions for partial strikes

The Government has reintroduced partial strike provisions to the Employment Relations Act 2000. Employers can make pay deductions in response to partial strike action.

Read the Minister’s announcements:

Pay deductions for partial strikes to be reintroduced(external link) — Beehive.govt.nz

NZ law change restores balance – fairer rules for partial strikes(external link) — Beehive.govt.nz

Partial strikes are industrial actions that fall short of a full withdrawal of labour (e.g. a go-slow order, partial discontinuance of work). They also include industrial action that involves a breach of the employee’s employment agreement.

For ‘work to rule’ action to be a partial strike, the action needs to result in either a reduction in the normal output or rate of work or involve a breach of the employees’ employment agreement.

The withdrawal of labour for voluntary activities is not considered ‘partial strike action’ if they are not part of someone's employment agreement or normal duties that they receive remuneration for based on past practice and employment conversations.

Employers cannot make a pay deduction for industrial action that involves refusing to work overtime, or refusing to perform on-call work (if the employee would otherwise receive a special payment for performing the work).

When a partial strike occurs, employers can either:

- reduce an employee’s pay by a proportionate amount (calculated in accordance with a specified method that is based on identifying the work that the employee will not be performing due to the strike), or

- deduct 10% of an employee’s pay.

An employer can choose whether to make a deduction in response to a partial strike. If they decide to do so, the employer must provide written notification about the deduction to employees.

This notice must be given as soon as reasonably practicable. It also needs to be given before the earliest of either:

- the deduction being made, or

- by the end of the first pay period within which an employee will be paid for the period in which the partial strike (or part of a partial strike) occurred.

Employers need to respond to written requests from unions for information on how specified pay deductions are calculated or applied.

If the union disagrees with the employer’s calculation or application of the specified pay deduction, and are unable to resolve the problem with the employer, the union can make an application to the Employment Relations Authority.

Specified pay deductions cannot be made for:

- strikes that end before the Bill comes into force, or

- any period of a partial strike that occurred before the Bill comes into force.

Find out more here:

Strikes(external link) — Employment New Zealand

Proactively released documents

Documents relating to providing greater certainty for contracting parties

-

Briefings: Advice on providing greater certainty for contracting parties [PDF 4.5MB]

Briefings: Advice on providing greater certainty for contracting parties [PDF 4.5MB]

-

Regulatory Impact Statement: Contractors – Providing greater certainty for contracting parties [PDF 868KB]

Regulatory Impact Statement: Contractors – Providing greater certainty for contracting parties [PDF 868KB]

-

Providing greater certainty for contracting parties [PDF 1.2MB]

Providing greater certainty for contracting parties [PDF 1.2MB]

-

Providing Greater Certainty for Contracting Parties – Minute of Decision [PDF 332KB]

Providing Greater Certainty for Contracting Parties – Minute of Decision [PDF 332KB]

Documents relating to introducing an income threshold for unjustified dismissal personal grievances

-

Initial advice on setting a high-income threshold for personal grievances [PDF 275KB]

Initial advice on setting a high-income threshold for personal grievances [PDF 275KB]

-

Personal grievances: A threshold for unjustified dismissals [PDF 230KB]

Personal grievances: A threshold for unjustified dismissals [PDF 230KB]

-

Personal grievances: Second order policy issues for an income threshold [PDF 369KB]

Personal grievances: Second order policy issues for an income threshold [PDF 369KB]

-

Advice on the transitional provision for the personal grievance income threshold [PDF 605KB]

Advice on the transitional provision for the personal grievance income threshold [PDF 605KB]

-

Extract from 2425-0319 MBIE Workplace Relations and Safety Policy weekly report for the period from 13 to 19 September 2024 [PDF 97KB]

Extract from 2425-0319 MBIE Workplace Relations and Safety Policy weekly report for the period from 13 to 19 September 2024 [PDF 97KB]

-

Regulatory Impact Statement: Introducing an income threshold for unjustified dismissal [PDF 523KB]

Regulatory Impact Statement: Introducing an income threshold for unjustified dismissal [PDF 523KB]

-

Introducing an Income Threshold for Unjustified Dismissal [PDF 147KB]

Introducing an Income Threshold for Unjustified Dismissal [PDF 147KB]

-

Introducing an Income Threshold for Unjustified Dismissal – Minute of Decision [PDF 136KB]

Introducing an Income Threshold for Unjustified Dismissal – Minute of Decision [PDF 136KB]

Documents relating to changes to eligibility to remedies for personal grievances

-

Initial advice on eligibility to remedies for personal grievances [PDF 263KB]

Initial advice on eligibility to remedies for personal grievances [PDF 263KB]

-

Further advice on eligibility for remedies for personal grievances [PDF 736KB]

Further advice on eligibility for remedies for personal grievances [PDF 736KB]

-

Decisions on eligibility for remedies for personal grievances [PDF 273KB]

Decisions on eligibility for remedies for personal grievances [PDF 273KB]

-

Extract from BRIEFING-REQ-0008363: MBIE Workplace Relations and Safety Policy weekly report for the period from 24 January 2025 to 30 January 2024 [PDF 138KB]

Extract from BRIEFING-REQ-0008363: MBIE Workplace Relations and Safety Policy weekly report for the period from 24 January 2025 to 30 January 2024 [PDF 138KB]

-

Regulatory Impact Statement: Strengthening consideration and accountability for the employee's behaviour in personal grievance process [PDF 577KB]

Regulatory Impact Statement: Strengthening consideration and accountability for the employee's behaviour in personal grievance process [PDF 577KB]

-

Strengthening consideration and accountability for the employee's behaviour in the personal grievance process [PDF 167KB]

Strengthening consideration and accountability for the employee's behaviour in the personal grievance process [PDF 167KB]

-

Strengthening consideration and accountability for the employee's behaviour in the personal grievance process – Minute of Decision [PDF 145KB]

Strengthening consideration and accountability for the employee's behaviour in the personal grievance process – Minute of Decision [PDF 145KB]

Documents relating to changes to employers' obligations when a new employee begins work

-

Briefing: Initial process options for considering changes to the 30 day rule [PDF 497KB]

Briefing: Initial process options for considering changes to the 30 day rule [PDF 497KB]

-

Regulatory Impact Statement: Removing the 30 day rule and reducing the related information disclosure and reporting requirements for employers [PDF 604KB]

Regulatory Impact Statement: Removing the 30 day rule and reducing the related information disclosure and reporting requirements for employers [PDF 604KB]

-

Freedom of Choice and Cutting Red Tape at the Beginning of Employment [PDF 352KB]

Freedom of Choice and Cutting Red Tape at the Beginning of Employment [PDF 352KB]

-

Freedom of Choice and Cutting Red Tape at the Beginning of Employment - Minute of Decision [PDF 404KB]

Freedom of Choice and Cutting Red Tape at the Beginning of Employment - Minute of Decision [PDF 404KB]

Documents relating to pay deductions for partial strikes

-

Employment Relations Amendment Bill 2025: Approval for Introduction [PDF 496KB]

Employment Relations Amendment Bill 2025: Approval for Introduction [PDF 496KB]

-

Employment Relations Amendment Bill 2025: Approval for Introduction – Minute of Decision [PDF 323KB]

Employment Relations Amendment Bill 2025: Approval for Introduction – Minute of Decision [PDF 323KB]

-

Regulatory Impact Statement: Partial strikes [PDF 456KB]

Regulatory Impact Statement: Partial strikes [PDF 456KB]

-

Employment Relations (Pay Deductions for Partial Strikes) Amendment Bill – Approval for Introduction [PDF 346KB]

Employment Relations (Pay Deductions for Partial Strikes) Amendment Bill – Approval for Introduction [PDF 346KB]

-

Employment Relations (Pay Deductions for Partial Strikes) Amendment Bill – Approval for Introduction – Minute of Decision [PDF 187KB]

Employment Relations (Pay Deductions for Partial Strikes) Amendment Bill – Approval for Introduction – Minute of Decision [PDF 187KB]

-

Collective Bargaining Rebalance – Allowing for Pay Deductions in Response to Partial Strikes [PDF 208KB]

Collective Bargaining Rebalance – Allowing for Pay Deductions in Response to Partial Strikes [PDF 208KB]

-

Collective Bargaining Rebalance – Allowing for Pay Deductions in Response to Partial Strikes – Minute of Decision [PDF 158KB]

Collective Bargaining Rebalance – Allowing for Pay Deductions in Response to Partial Strikes – Minute of Decision [PDF 158KB]